in under 1-Min!

Merchant services: Sagepay merchant accounts, an interesting alternative to high-street bank offerings

Not many businesses would think about Sage as a financial institution, capable of offering all the services related to a merchant account. However, Sage’s footprint in the business software industry, their experience as a payment services provider and success as an established corporation do legitimate their recent merchant account offering. And the service itself has interesting, original features.

Principle

As a independent sales organization and payment service provider, Sage directly offers the same merchant account features a high-street bank package would. With some differentiating twists.

A unpackaged solution, with only what the customer needs

The main characteristic of a Sagepay merchant account is that the customer will not subscribe for a package solution, but only pays for the payment method he wishes to propose to his own end-customers.

Possible choices are detailed further down in this article.

A cheaper solution... to direct customers towards the software offering

As the customer only pays for what he really needs, and as Sage does not have a network of physical agencies, costs of a Sagepay merchant account are constrained in comparison with high-street bank merchant accounts.

Furthermore, Sage advertises their merchant accounts do not have any hidden fee: there’s a monthly fee depending on a predefined volume of transactions, and that’s it.

The interest in Sage here is to direct their Sagepay merchant account customers to Sage’s business software offering, which includes:

• payroll management,

• accounting software,

• WFM software,

• ERPs...

In fact, Sage is even offering software integration for free to their merchant account customers.

Different types of Sage pay merchant accounts

Face-to-face account

For in-store payments, Sage will send the customer either a stand-alone card machine or a fully integrated payment solution, with ePos software and terminal.

The problem for the prospective business customer is that even though Sage advertises rates as low as £13 per month, accurate pricing may only be obtained after a quote has been requested.

Online payment account

This kind of account allows secure online payments for e-commerce websites. Depending on the chosen plan, available packages include:

• from 350 to 3 000+ transactions per month,

• fraud screening tools,

• 24/7 support,

• integration with popular e-commerce platforms,

• various credit card and local currencies support.

Phone payment account

Phone payment accounts include:

• between 100 and 1500+ transactions per month,

• fraud prevention tools,

• integration with CRM, IVR, accounting software,

• cloud-based reporting tools.

eInvoice payment account

This alternate payment method actually allows customers to pay through a “pay now” button located on the electronic invoice sent by the merchant.

Benefits of a Sagepay merchant account

Sage boasts may benefits to their merchant accounts

True independence

Customers are not tied with a high-street bank, and customers can change their plan to better match their needs effortlessly.

Resilient systems

For added security, all solutions have built-in resilience, so that no sale can be missed.

Multi-channel solution

Depending on the selected plan, and software package, the customer will have access to a full multi-channel solution accepting all online and offline payment methods, with the software to efficiently manage centralized reporting.

An established partner

Sage is the third biggest European software vendor, and has been around for over thirty years. They are at the same time offering the flexibility and benefits of a new player in the field of merchant accounts, and the peace of mind associated with established businesses.

Discover the buying guide for Merchant services

-

Choosing the right online payment system for your website

-

The advantages of using smart card readers in commerce

-

Mobile credit card machines: choosing the right technology, at the right price

-

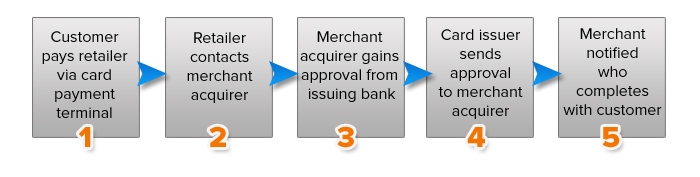

The journey of a credit card payment

-

Finding the right chip-and-PIN machine, at the right price

-

PDQ machines for small businesses: why and how to get them?

-

How mobile payments can benefit your business?

-

Mobile payment terminal

-

Choosing a credit card reader

-

Contactless payment solution