in under 1-Min!

Merchant services: The journey of a credit card payment

When you pay for goods or services on your debit or credit card, the transaction appears to take place immediately. A card terminal is used to take payment, a receipt issued and then a few days later, when you check your bank statement, you notice that the money left your account.

However, there is in fact a complex sequence of events that take place ‘behind the scenes’ to make each credit card transaction occur. This consists of a number of players:

Customer

This is the card holder, using a debit or credit card issued to them by a bank or building society to make a payment.

Retailer

In financial terminology, you will often see the retailer called the merchant. This is the shop, website or business that takes payment for the merchandise sold or services rendered.

-

Issuing bank

The bank or financial organsiation who has provided the payment card to the customer, which is being used in the transaction.

Merchant acquirer

Also known as a merchant bank, all businesses that wish to carry out credit card processing must set up a business merchant account with a merchant bank. The merchant acquirer may also be able to sell or lease card payment terminals.

Card scheme

These are companies that control the operation and payment of card transactions. They pass information between merchant acquirers and issuing banks (examples of card schemes are Visa, MasterCard and American Express).

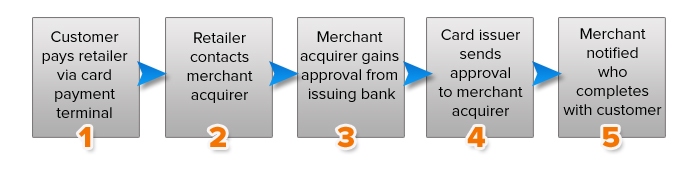

1. The customer uses their payment card to pay for goods or services using the retailer’s card payment machine. This is usually a chip and pin terminal and it is common for the retailer to be using mobile card readers, bringing the payment process directly to the customer.

2. Once payment has been taken, the retailer requests authorisation from their merchant acquirer, who will collect transaction details from the PDQ machines. A pre-negotiated fee will be applied for this service, either as a percentage of the credit card transaction amount, or as a fixed fee per transaction.

3. The merchant acquirer then gains authorisation for the transaction by contacting the card holder’s issuing bank to check for funds. Contact is made through a card scheme.

4. Once the card holder’s bank approves the transaction (details must be validated and funds confirmed) the approval is sent back to the merchant acquirer (through a card scheme) who forwards approval back to the retailer.

5. The retailer can now complete the transaction with the customer and issue a receipt from their business’s card terminal. The merchant acquirer will credit the retailer’s business bank account within a few working days and the issuing bank will debit funds from the customer’s bank account.

Discover the buying guide for Merchant services

-

Choosing the right online payment system for your website

-

The advantages of using smart card readers in commerce

-

Sagepay merchant accounts, an interesting alternative to high-street bank offerings

-

Mobile credit card machines: choosing the right technology, at the right price

-

Finding the right chip-and-PIN machine, at the right price

-

PDQ machines for small businesses: why and how to get them?

-

How mobile payments can benefit your business?

-

Mobile payment terminal

-

Choosing a credit card reader

-

Contactless payment solution